Picture this: a factory worker in Japan, wiping sweat from his brow, watching the clock tick down as he rushes to finish one last shipment. In Britain, a small business owner stares at a stack of unpaid bills, wondering how she’ll keep the lights on. Across the United States, a steelworker clocks out early, his gut churning with worry about what’s next. These aren’t just statistics—they’re people, and they’re all feeling the same dread. Factories around the world are reeling, caught in the crosshairs of new U.S. tariffs that President Donald Trump plans to unveil on what he’s calling “Liberation Day” this Wednesday, April 2, 2025.

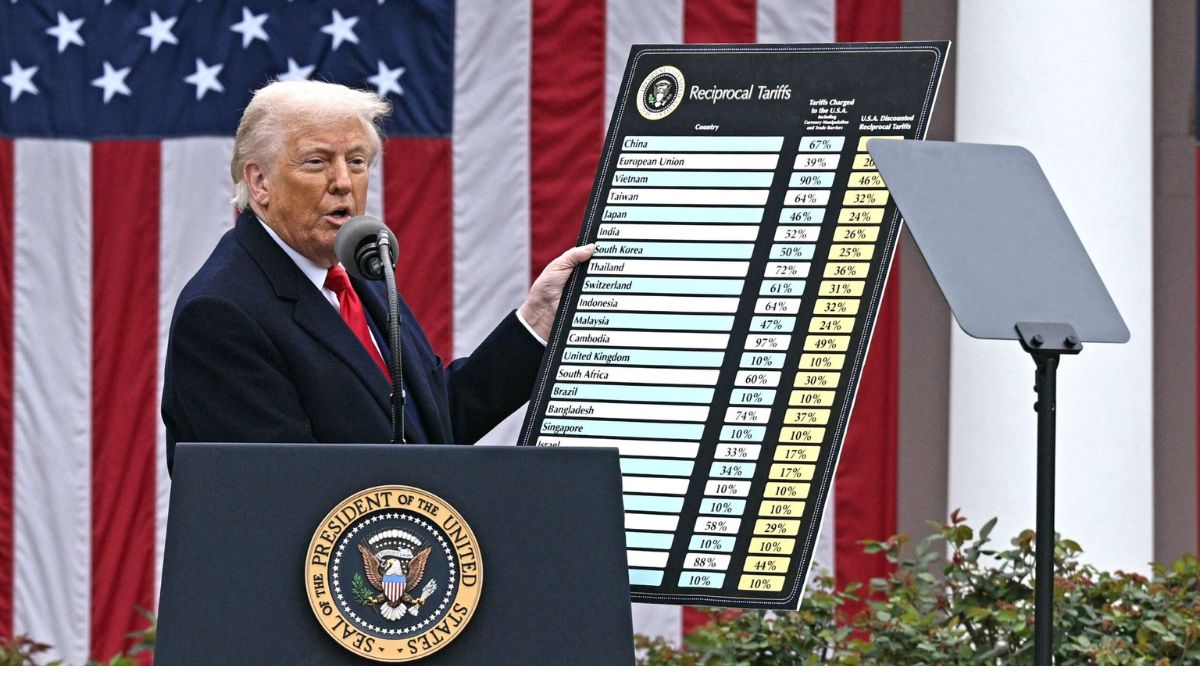

Trump’s already slapped levies on aluminum, steel, and cars, and jacked up tariffs on everything coming out of China. Now, he’s promising more—a sweeping wave of duties that’ll hit every corner of the globe. He says it’s about making trade fair, but for the folks on the ground, it feels like a punch to an economy that’s barely standing after COVID, political chaos, and wars that keep the world on edge.

March was a rough month, and the numbers tell the story. Those Purchasing Managers’ Index (PMI) surveys—the ones that show how businesses are feeling—came back grim. In Asia, it’s like someone flipped the lights off. Japan’s factories slowed to a crawl, the worst in a year, as workers packed up early and machines sat idle. South Korea’s hustle faded fast, and Taiwan’s workshops felt the chill, too. Everyone’s asking the same question: how do you keep going when the world’s biggest customer is about to slam the door?

China’s the odd one out, though. Over there, factory floors are buzzing—workers pulling overtime, trucks racing to ports. They’re scrambling to get stuff to the U.S. before the tariffs kick in. “It’s like a last-minute Christmas rush,” says Julian Evans-Pritchard, an economist at Capital Economics. “But once those duties hit, that energy’s going to crash hard.” It’s a fleeting burst of hope in a sea of worry.

Back in the U.S., the mood’s just as heavy. Factory workers who’d been optimistic at the start of the year are now clocking shrinking shifts. The ISM’s manufacturing PMI slipped to 49.0 in March—below that magic 50 line that means things are growing—down from 50.3 in February. New orders? They’ve tanked to levels not seen since May 2023. “You can feel it,” one Ohio plant manager told me. “Folks are scared—scared of losing orders, scared of losing jobs.”

Europe’s a mixed bag. Some factory towns are seeing a flicker of life—Germany’s got machines humming again after almost two years of quiet, and France’s downturn isn’t biting as hard. But don’t be fooled. “It’s all about beating the tariff deadline,” explains Cyrus de la Rubia from Hamburg Commercial Bank. “People are shipping like crazy to the U.S. now, but once that window closes, we’re in for a rough ride.” In Britain, it’s a different story—pure gloom. Manufacturers are getting hammered by the tariff threat and talk of tax hikes at home. Orders are drying up, and hope’s in short supply.

The stock market’s a rollercoaster—up one day on Wall Street’s coattails, while gold hits record highs as jittery investors cling to something solid. But other signs aren’t so shiny. South Korea’s exports are sputtering, and Japan’s big manufacturers are admitting they haven’t felt this low in a year, according to the tankan survey.

Trump’s “Liberation Day” isn’t just a catchy phrase—it’s a promise of tariffs that could hit 10% or 20% on everything from electronics to clothes. His fans cheer, saying it’ll bring jobs back home. But the workers I’ve talked to—here and abroad—aren’t so sure. They’re picturing empty shelves, higher prices, and maybe even payback from countries ready to fight fire with fire. The World Trade Organization’s already whispering about a 5% drop in global trade if this explodes into a full-on trade war.